Supervisory Framework

A robust and resilient financial institution (FI) system is one of the Bank of Thailand (BOT) mission in retaining the stability of Thai economy. The stable FI system would encourage the role of FI in transferring the fund in financial system and the operation of fiscal policy. These would allow the smoothness and the sustainability in financial system and economy.

The BOT not only supervises, examines and monitors the FIs with transparency, prudent, preventive and well-prepared for new risks which are challenges to the stability but also is not the obstacle to the development and innovation. The objectives of FI supervision are (1) to ensure that FIs are prudent and have proper risk management system (2) to enhance the overall efficiency of FIs (3) to ensure good corporate governance of FIs (4) to ensure that FIs are fair and equitable to their customers and (5) to safeguard economic and financial stabilities (Macroprudential).

To achieve these objectives, the BOT appointed Supervision Group to supervise, examine, analyze and monitor the financial status and performance, and risk management system of the individual FI and the FI system, to detect early warning signals, co-grant the approvals as well as take Supervisory Actions on troubled or non-compliance FIs. These would ensure the stability of FI as well as promote the confidence to public.

The BOT strives for efficient FI supervision which is in line with the international standards. These would ease the identification of both existing and potential problems of FIs as well as problems which could affect the stability of FIs and the confidence in FI system. In addition, these would ensure that problems would be solved accurately in timely manner

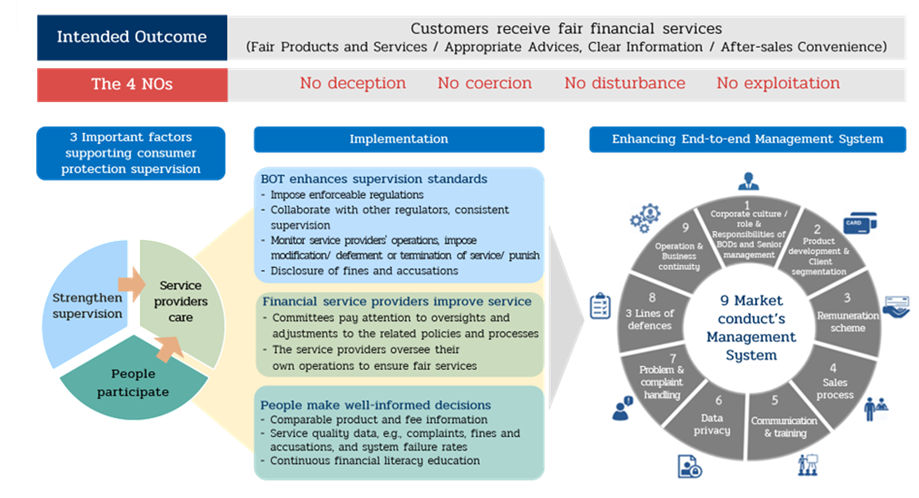

Market Conduct Supervision

The Bank of Thailand has always placed importance on protecting the rights of financial consumers. In 2016, Financial Consumer Protection and Market Conduct Department was established to supervise and issue regulations regarding proper market conduct practices, which play an important role in raising the supervising standard.

In the regulatory process, the Bank of Thailand supervises the conduct of financial service providers such as financial institution, specialized financial institutions, credit card service providers, operators of personal loan business under supervision, operators of nano finance business under supervision, asset management company to ensure that they have appropriate and fair management practices related to customer service. The financial consumers must receive fair services without being deceived, coerced, disturbed, and exploited.

Furthermore, the Bank of Thailand’s Financial Consumer Protection Center (FCC 1213) ensured that customers’ problems were being taken care of effectively. The customers can seek for an advice or submit complaints about financial services with the FCC through numerous channels.

Additional information for consumers (Thai Version Only)

The Financial Sector Assessment Program (FSAP)

What is FSAP?

The Financial Sector Assessment Program (FSAP) is a joint program initiated by the IMF and World Bank in May 1999, with the aims to (1) identify the strengths and weaknesses of a country’s financial system, (2) assess a country’s compliance with the international best practices, (3) promote the financial system’s development as well as provide technical assistance needed, (4) specify risk management strategy and (5) help prioritize policy responses and strategic plans.

FSAP covers assessment of various issues in the financial sector, for example, banking, securities, insurance, monetary and financial policy transparency, payment and settlement systems, and anti-money laundering. The assessment comprises three main components, namely, (1) financial sector analysis, including analysis of efficiency, competitiveness, concentration, and liquidity, (2) macroprudential analysis, including stress testing, scenario analysis, and analysis of financial soundness indicators and macrofinancial linkages, and (3) assessment of observance to international standards and codes.