1. What is PromptBiz?

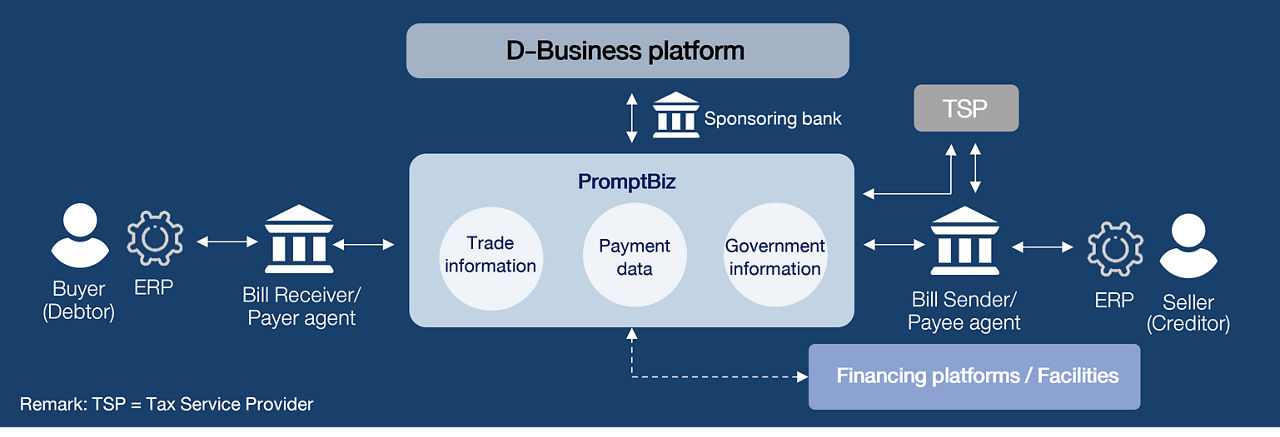

PromptBiz is a unified financial infrastructure for cross-bank digital transmission of trade and payment data in business processes. The digital footprint of e-Invoices, transactions, and e-Receipts can be used when requesting for financing.

2. Which services are available under the PromptBiz system?

In the first phase of implementation (starting from August 2023), PromptBiz offers two main services including:

• Digital Trade and Payment is a service for sending and receiving trade documents in electronic form such as e-Invoice and e-Receipt and paying for these invoices via Bulk Payment (formerly known as SMART, a cross-bank transfer service).

• Digital Supplychain Finance is an extended service built on the Digital Trade and Payment feature. It utilizes trade transactions from the PromptBiz system, which have been verified for authenticity and double financing, as supplementary documents to apply for invoice factoring/financing. This would increase the chance for SMEs to access easier and faster sources of finance, with competitive loan terms compared to conventional revolving loans.

3. How is PromptBiz beneficial to each economic sector?

PromptBiz is holistically beneficial to the economy, including the business sector, financial sector, and government sector. It is an essential driver for economic growth.

• Benefits to the business sector

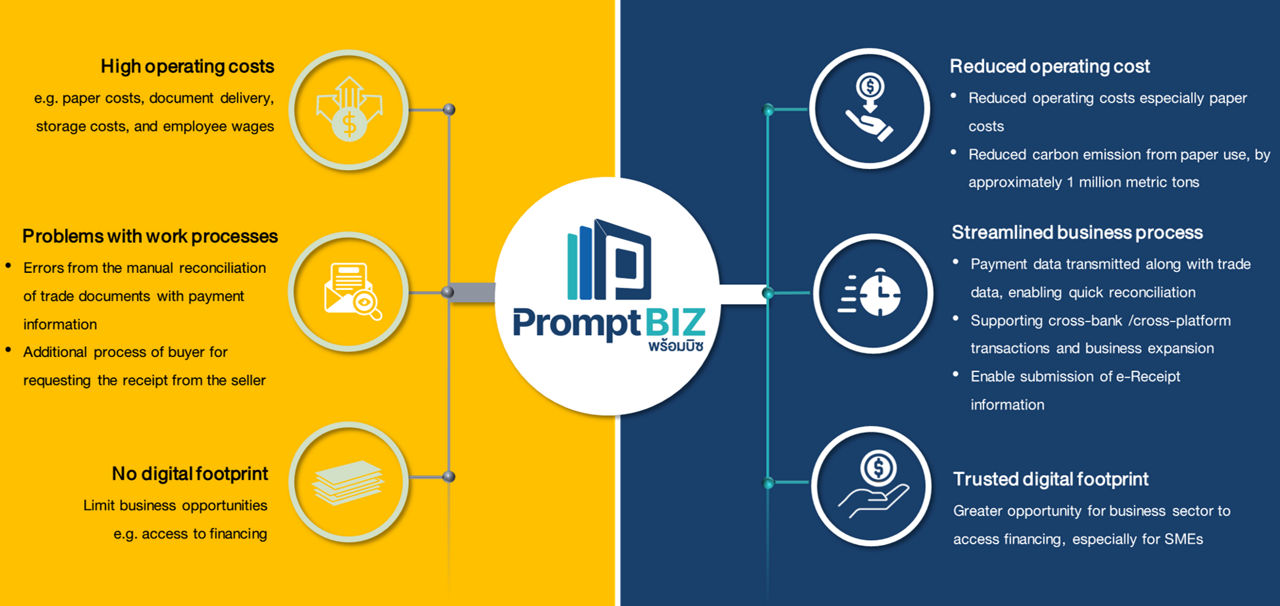

1. Increase efficiency and reduce errors in business operations by reducing manual processes, verifying transactions, and allowing cross-bank transfers. This will help increase the competitiveness of the Thai business sector.

Seller: Increased convenience in delivery of e-Invoice and e-Receipt, more efficient data management, and no obligation to own accounts in every bank to accommodate buyer’s specifications.

Buyer: Pay alert when receiving e-invoice and prompt generation of e-receipt after payment

2. Reduce operating costs especially ordinary expenses such as paper expenses, document storage & delivery costs; as well as other hidden opportunity costs e.g. wages, and time. Additionally, carbon footprint can also be reduced.

3. Increase the chance for SMEs to assess sources of finance by providing a trusted digital footprint of trade and payment transactions, which can be used as a supplementary document for loan applications. This digital footprint facilitates the loan application process as transactions are authenticated and checked for double financing.

• Benefits to lenders/financial providers

Raise the efficiency of services and increase business opportunities by enlarging the trade and payment database as well as customer base, reducing credit risk by using trusted information, expanding the range of services, and developing new financial or payment innovations (e.g. information-based lending) by utilizing the PromptBiz infrastructure, responding to needs of digital businesses in the future.

• Benefits to government sector

Increase efficiency of government processes and support Digital Government policy through digitalizing procurement and payment processes. The government can utilize digital information for developing and formulating government policies that are more targeted for the next period e.g. measures to promote the business sector to digital systems.