A Significant Step in promoting Sustainable Banking in Thailand

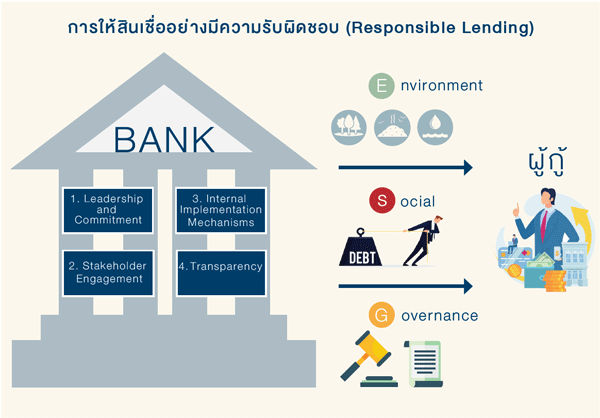

Sustainable Banking Guidelines – Responsible Lending

MoreThe BOT, as a regulatory body overseeing financial stability, recognizes the importance of technological advancement and environmental changes. Such trends present opportunities for Thailand’s financial sector not only to improve financial services but also to facilitate businesses transition towards sustainability. At the same time, these changes also come with new challenges. If the Thai financial system is late to adapt to these trends, they could potentially pose risks to financial stability, leaving the Thai economy to fall behind their peers, or even exacerbate economic and social inequalities.

Engaging financial institutions

The financial sector’s fundamental role in allocating resources to the economy by considering the sustainable growth of public and private sectors and accountable to ESG

What public and private sectors will gain from sustainable finance

The BOT emphasizes sustainable growth, particularly environmental conditions that are rapidly getting worse and more severe, including inequality, which is a major structural issue in Thailand. Therefore, in order for the Thai economy to transition toward being more environmentally friendly, the BOT will encourage the financial sector to be able to properly evaluate environmental risks and impacts, as well as support private sector transitions to ensure that transitions are smooth and sustainability and do not have widespread negative repercussions.

Sustainable Banking Guidelines – Responsible Lending

More