1. Leveraging on Technology and Data to Drive Innovation

Leveraging on technology and data to drive innovation and better financial services through Open Competition, Open Infrastructure and Open Data.

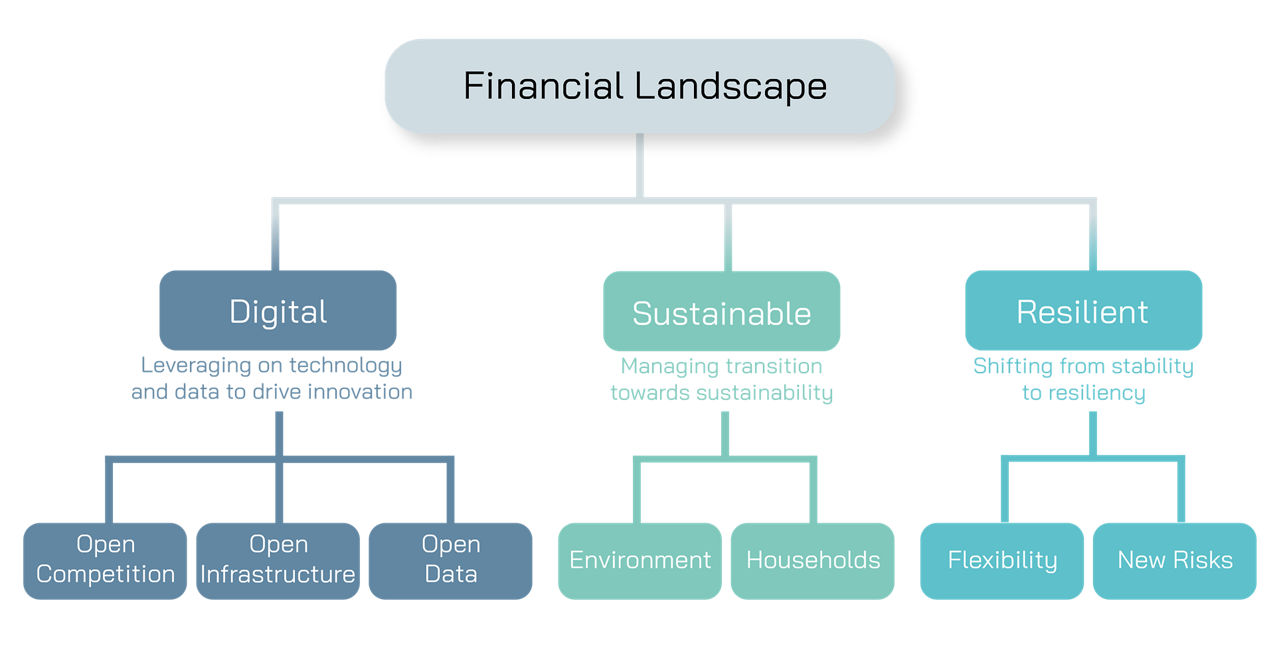

Financial Landscape

for Digital and Sustainable Economy

Thailand’s economic and financial system is going through a transformation. Technological advancement has accelerated an upgrade of financial services and narrowed the gap in financial access for businesses and households. However, businesses and households that are unable to adapt to the change in technology will risk falling behind even further. This could exacerbate the existing structural economic problems such as household debt and inequality issues. Meanwhile, environmental challenges have also become more imminent as the impact on the economy has been more rapid and more amplified than previously expected—both from more severe changes in weather conditions and natural disasters as well as environmentally-related trade barriers imposed by many countries.

In this rapidly evolving environment, the repositioning of the financial sector needs to strike the right balance between promoting innovation and managing risks. Moreover, the financial sector needs to be more flexible in dealing with abrupt changes. This balance is necessary to enable the financial sector to adapt to the new challenges while maintaining the economy’s resilience on course for a sustainable digital economy.

(Download ducument, please click the box)

2004-2020

Sep 2022

Jan - Jun 2023

Nov 2023

Leveraging on technology and data to drive innovation and better financial services through Open Competition, Open Infrastructure and Open Data.

Both new and incumbent players are welcome to establish a virtual bank. The objective of the virtual banking license is to foster competition in developing financial services, promote innovations that meet consumer needs, as well as improving suitable access for the retail sector and SMEs.

Allow more flexibility regarding the business scope of financial institutions so that the existing players can better compete, innovate, and meet consumer needs.

For instance, the investment limit on FinTech investment, excluding that in digital assets—currently at no more than 3 percent of the bank’s capital—will be lifted for subsidiaries and affiliates within a banking group.

Expand the Scope of Business for NBFIs

- Allow e-Money service providers to operate as escrow agents and provide identity verification and authentication services (Identity Provider: IdP in the electronic-Know Your Customer (e-KYC) process).

- Allow Money Transfer (MT) and Money Changer (MC) operators to offer a broader range of services and higher transaction amount limits and provide electronic services that utilizes technologies to improve efficiency and lower costs.

- Plan to revise non-bank MT/MC licenses to allow for broader scope of businesses and services to better serve retail customers and SMEs.

Support the Roles and Functions of SFIs

Collaborate with other relevant agencies to assist SFIs in closing the gaps unmet by existing market mechanisms or other infrastructures, but not in a manner that encourages them to directly compete with private players or other SFIs. Moreover, support on personnel capacity building and sharing common infrastructure among SFIs will enhance their role in closing such gaps, which should incur the least possible fiscal burden.

Both new and incumbent financial service providers may consult the BOT, on a case-by-case basis, concerning other banking business models (which are not a virtual bank), or other financial businesses under the BOT’s supervision.

Promote efficient utilization of domestic payment system infrastructure by connecting and opening to different service providers, thus enabling them to compete at reasonable costs to serve needs of the public and different business segments.

Enhance the Governance Framework

Enhance the governance framework of domestic payment system infrastructure for greater utilization and innovation by exploring different approaches that may be suited to Thailand’s context.

- One approach is to establish a Payment Council, as has been done in other countries such as Australia and Singapore, involving various stakeholders such as commercial banks, NBFIs, consumers, regulators, and experts. They can participate in the design of payment-related policies that will later be proposed to the Payment Systems Committee (PSC), whose responsibility is to set Thailand’s payments-related policies and implement such policies to achieve tangible outcomes.

- A Payment Scheme agency will manage scheme rules related to payment systems and services, e.g. terms on business operation and system development, fee structure, promotion of digital payments, and supporting innovation.

Review the Pricing Structure of the Payment Systems

Review the pricing structure of payment services, particularly for cash and cheques to ensure that it is appropriately reflecting underlying costs, reasonable and fair to consumers, service providers, and developers of infrastructure. The BOT will consult with stakeholders and conclude the fee structure within 2022, and later construct a plan to adjust fees, particularly for cash and cheques. This will serve the policy direction towards doubling the rate of decline of the current cash usage within 3 years, and to reduce the use of paper cheques to less than half within 5 years. During this period, digital payments will have advanced enough to scale up adoption by the businesses and households, which will aid Thailand’s transition to a less-cash society.

During this transition, there must be efficient channels to provide payment services to those who are not yet ready to adopt digital payments. For example, the establishments of white label smart machines and banking agents can help disburse cash in remote areas, which would help ensure efficient management at lower costs, in line with the declining trend in cash usage.

Develop End-to-End Digital Processes for Businesses

Develop ‘Smart Financial and Payment Infrastructure for Business’ in collaboration with the relevant public and private entities, to enable end-to-end digital business; link data on business transactions, payments, and tax through an automated straight-through process. This aims to reduce costs, improve efficiency, and create digital footprints to improve access to funding at reasonable costs. In addition, a high-value payment system will be developed to accommodate business and capital market transactions.

Develop Retail Central Bank Digital Currency

Develop and launch a pilot test for Retail Central Bank Digital Currency (Retail CBDC), a digital form of central bank money. Retail CBDC is an infrastructure that aims to provide open access to more service providers, allowing them to innovate through the implementation of new technologies. The objective of Retail CBDC is to transition Thailand to a digital economy with a safe, efficient, and low-cost option to utilize digital currencies. The pilot test is expected to be launched around the end of 2022.

Develop Standards and Support Interoperability

Support the development of other necessary digital infrastructures, standards and interoperability of key infrastructures in collaboration with the relevant agencies including:

1. Digital ID infrastructure that is interoperable across different platforms and open to various service providers, enabling them to verify their customers’ identities using reliable data sources at reasonable costs. This will in turn allow customers to verify their identity to use financial services conveniently and securely. The initiative includes verification and authentication of corporate digital IDs through the National Digital ID (NDID) infrastructure, in collaboration with the Department of Business Development and Electronic Transactions Development Agency (ETDA).

2. Digital signature infrastructure that is low-cost, user friendly, and universal to various product designs, for example ready-to-use platforms and digital financial contracts used in digital lending and digital debt-restructuring.

Promote Digital Literacy

Promote digital literacy and encourage public and private sectors to prioritize using digital payments over cash and cheques by collaborating among public agencies, industries and financial sector. A working group on promoting digital literacy and payments is an example of an integrated effort to create understanding and promote the use of digital payments as a national-level agenda, to ensure concerted and consistent communications and efforts that result in tangible outcomes.

Develop credit guarantee mechanisms to meet various funding needs, by collaborating with other public agencies to establish a General Credit Guarantee Facility (GCGF). The GCGF aims to provide better access to funding sources for businesses, especially SMEs. The design will accommodate different stages in their business cycle, those facing liquidity problems as affected by a financial crisis, and those seeking infrastructure financing. Key characteristics of the GCGF are the following:

1. It can guarantee loans issued by financial institutions and NBFIs.

2. In addition to loans, the facility covers various types of funding that are more suitable for start-ups, medium-sized enterprises who are ready to enter the capital market, and large corporates that seek to form joint ventures or issue debts or equities.

3. It can provide support for investments in line with the country’s long term strategic directions and economic development plans. The enhancement of credit guarantee mechanisms, especially in assessing credit risk of a debtor or the guaranteed project, can ensure that risks are effectively managed, and the guaranteed fees are risk-based consistent with the debtor or the project.

Implement Open Banking policies that enable data owners to easily transfer their own data from one service provider to another at reasonable costs, with no barriers in choosing or switching their service providers. Open Banking requires developing data exchange mechanisms, in collaboration with financial institutions, that allow data owners to give consent to financial service providers to disclose or send their data to third party providers. Also, setting standards for Application Programming Interface (API), data and security are necessary to enable the transfer of data between service providers. This will ensure operational standards to share data in an efficient, secure, and quick manner without imposing restrictive conditions or charging excessively high fees that would hinder data owners from accessing and utilizing their own data. A pilot program was launched in January 2022 with bank statement transactional data (Digital Statement: dStatement) with future plans to expand the scope of data exchanges to other service providers in the financial and non-financial sectors e.g. insurance premium payments, utility bill payments, etc.

Promote database connectivity and the effective utilization of micro-level data for analytics and development of financial innovations and services. A collaboration among private and public agencies will be set up to develop mechanisms, infrastructure and legal framework amendments to facilitate the linkage of micro-level data from various agencies and form big data comprising both financial and non-financial data (e.g. behavioral data on money transfers and payments). Such extensive database will be useful for conducting comprehensive data analytics, supporting public policy initiatives, and developing financial innovations and services. For example, a data-driven, risk-based models using the borrower’s behavior and debt serviceability data can help determine interest rates for thin-file borrowers and SMEs with insufficient credit history, thus allowing them to have better access to formal lending.

In addition, micro-level database must be subject to proper data governance and must not violate data privacy rights. For example, only anonymized and pseudonymized data are available for third parties to access for analytics, with mechanisms or strict security procedures to prevent data leakages.

The BOT is giving high priority to the issue of sustainable growth, especially that related to the environment, which has rapidly gained grounds and materiality more than previously anticipated. In this regard, the BOT is taking actions to steer the financial sector to incorporate environmental considerations into their risk assessments, support businesses in coping with environment-related risks and transitioning away from environmentally unfriendly activities without disrupting the economy. Another focus is the issue of inequality which is a key structural weakness in Thailand. The BOT will need to ensure that its policies can enable households and vulnerable groups to adapt to the new global trends. Two proposed directions are as follow.

Actively encourage the introduction of new financial services and products that would help businesses adapt and transition away from activities that are environmentally unsustainable. The BOT will collaborate with financial institutions to develop good practice guidelines including the conduct of scenario analysis as well as climate stress testing

Promote the development of a national green taxonomy. The Thai Taxonomy will establish the definition of what economic activities are considered ‘green’ or ‘in transition’ in a manner that is appropriate and suitable to Thailand’s context. The taxonomy should help identify and promote allocation of resources towards those activities. Emphasis would initially be placed on industries that lag behind in the transition, especially those that emit large amounts of greenhouse gas. The Thai Taxonomy will also be aligned with the ASEAN Taxonomy as well as other internationally recognized taxonomies such as the EU Taxonomy and the Climate Bonds Taxonomy.

Set disclosure standards so that financial institutions could show their commitments and actions on environmental sustainability in a manner that is clear and consistent with international standards such as those recommended by the Task Force on Climate-related Financial Disclosures (TCFD). The BOT will also collaborate with other regulatory agencies to encourage the adoption of disclosure standards among other financial players as well as non-financial businesses to make environment-related data more widely available in Thailand. The BOT will also consider the possibilities of pushing forth the creation of data platform to facilitate data connectivity and information sharing between different agencies, both within and outside the financial sector, to support the analyses and assessment of climate-related risks and opportunities.

Put in place mechanisms or measures to help alleviate the burden or cost of adjustments for financial institutions and businesses will facilitate a timelier transition. Particularly, the aim is to increase SME’s access to the financing they need to adjust and transition to a more sustainable practice. One example is Singapore’s grant scheme to help reduce the validation expense of green loans application.

Build competencies and skills in the financial sector. The BOT will collaborate and exchange views and experiences with other financial regulators and banking associations to build up the capacity of financial sector personnel so that they are equipped with competencies and skills to utilize the tools, appropriately assess climate-related risks and opportunities, and learn from experiences of experts in the fields, relevant agencies, and international communities.

Promote financial literacy and digital financial literacy to bring about a change in people’s financial behavior and help them keep up with development of new technologies and financial innovations.

1. Develop a database for financial and digital finance literacy. In collaboration with relevant agencies, this knowledge resource should be easily accessible, up to date with latest financial frauds, and tailored to the needs of the target groups.

2. Encourage financial service providers to play a role in incentivizing good financial discipline among consumers such as saving for retirement or making debt repayment on time or before the due date.

Ensure responsible retail lending practices that account for borrowers’ repayment ability to prevent over-indebtedness. Under BOT’s supervision, financial institutions and retail credit providers should ensure that their lending practices take due consideration to ensure that borrowers would still have enough disposable income to cover the basic spending needs. Moreover, households should not become overindebted especially from borrowing for unnecessary consumption spending. For instance, the total debt service ratio (DSR) should be a priority consideration, especially when lending to the vulnerable groups. This is also the case for when the borrower could arrange to have the debt service amount deducted from their salary income in advance. The BOT will closely monitor developments in household debt and consider the need for macroprudential measures to help slow down borrowing for unnecessary consumption spending once the economic recovery gains traction.

Promote holistic mechanisms for resolving debt so households can adjust and make a recovery over the longer-term without returning to insolvency. The BOT will collaborate with related agencies to devise a plan that would bring about sustainable solutions for households that owe large amounts of debt to financial service providers or other bodies such as saving cooperatives, governmental employees (e.g. loans benefit for civil servants), and the Student Loan Fund. This includes

- designing repayment plans that are appropriate to borrowers’ ability to service debt over the longer-term, whilst retaining enough disposable income after debt repayments;

- adjusting regulations or loan terms to reduce and ensure fair debt burden such as by applying the repayments to the principal amount first;

- offering terms that incentivize borrowers to continue repaying their debts on time and complete debt repayments earlier such as by reducing the principal owed for those with good repayment track record.

Promote a collection of comprehensive credit data issued by various financial service providers or agencies and utilization of those data to enhance retail credit underwriting. The data should support creditworthy households to have access to credit with risk-based pricing. Those data should also be utilized in tackling insolvency and reducing over indebtedness.

- One possible solution in the short-term is to collaborate with relevant agencies to encourage non-bank retail credit providers and key saving cooperatives to become members of the National Credit Bureau (NCB).

- Over the longer-term, the databases of various agencies should be connected into one large database that financial service providers can leverage to develop and offer financial products that better fit the needs and capabilities of the borrowers. Such data should also be further used in developing a scoring system to promote good financial behavior and credit culture in the financial system.

Adopt a more flexible approach on supervision that will enable financial service providers to adapt, innovate, and effectively manage new types of risks. Moreover, it is important to focus on effective regulations pertaining to systemically important players in order to reduce systemic risks.

Apply a risk-proportionality approach to the supervision of increasingly diverse service providers. The BOT seeks the optimal combination of (i) a rule-based approach to set standards or minimum requirements and (ii) a principle-based approach that enables financial service providers to adopt risk management processes suitable to their risk profiles. Moreover, service providers will carry the burden of proof to demonstrate their risk management abilities to the supervisory agency according to the degrees and types of risks pertaining to the service providers

Review regulations that are currently limiting the service providers’ abilities to adapt, compete, innovate, or serve customers better. Examples,

- include promoting risk-based pricing on retail lending rates before a review to lift the interest rate ceiling for retail loans. As a result, borrowers whose risk levels are below the ceiling rate will face lower interest rates while also expanding credit access to those with higher risk.

- Another revision aims to review the Regulatory Sandbox to improve clarity on the criteria and processing time to reduce burdens on participants. On this front.

Establish an exit mechanism that allow financial service providers facing business challenges or are unable to compete, to cease operations without disrupting the financial system or inflicting large-scale losses to the economic and financial system, depositors, and consumers. The BOT aims to set up conditions and procedures for the service providers to return their licenses or registration certificates and exit in an orderly fashion. In addition, there will be a license/ certification revocation process for the service providers who do not conduct businesses appropriately such as those with prolonged period of inactivity or willful non-compliance.

The BOT discourages the adoption of digital assets as a means of payment (MOP) for goods and services. A wide-scale replacement of the Thai baht by digital assets would create a new unit of account and adversely affect the public and the economy in several aspects namely:

1. cost and security of both payers and receivers, since digital assets are subject to high price volatility and the lack of security standards makes them well suited for facilitating money laundering;

2. payment systems stability, since digital assets can cause fragmentation and redundancy within the payment systems weakening their efficiency and increasing transaction costs; and

3. financial stability and management of domestic financial conditions: the absence of an organization with the ability to inject liquidity in the form of digital currency during crisis, for instance, can compromise the financial stability.

Nonetheless, for certain digital asset-related services and systems that can enhance the payment systems and financial innovation, the BOT would seek to provide suitable supervision to protect consumers and address risks to the financial and payment systems stability. Examples of the services under BOT’s consideration include the issuance of Thai baht-backed stablecoins. The oversight would consider the nature of services provided and their associated risks in the following dimensions:

1. scope of businesses;

2. stability mechanisms; and

3. maintenance of IT system security and data privacy.

Uses of Digital Assets in Financial Institutions or Associated Business Groups

Financial institutions or associated business groups who seek to adopt decentralized computing technology (e.g. blockchain) that requires the holding of digital assets to increase efficiency in financial services or banking affiliates looking to conduct business related to digital assets can consult with the BOT on a case-by-case basis. Considerations will be based on the overall benefits, operational guidelines and risk management practices including proper protection of depositors and consumers. It must be noted that the applications or business models related to digital assets must not support their use as means of payment (MOP) for goods and services.

Appropriate supervision of commercial banks’ financial business groups, especially those undergone organizational restructuring as part of the effort to leverage new technologies and digital infrastructure. These include FinTech or e-commerce platforms that are connected to financial services.

Enhance Governance and Risk Management

Enhanced supervision of corporate governance and risks of financial business groups, using risk-based approach and considering their significance to the respective commercial banks and their financial business group. Specifically, attention would be paid to roles of boards of directors of holding companies that are also parent companies with regards to risks oversight and prevention of any conflict of interest. Another area of focus is supervision of evolving IT/cyber risks undertaken by firms within the financial business groups which seek to capture opportunities presented by new technology and digital channels. The IT/cyber risk supervision framework for NBFIs would correspond with their risk profile and would be under the same standard that financial institutions comply to.

Supervise the Financial Business Groups

Supervise transactions within financial business groups as well as between commercial banks and their respective business groups. The oversight will monitor, for instance, funding or loan provision by commercial banks; shared distribution channels such as branches, digital and other sales channels; shared system; and customer data utilization to prevent the transmission of risks between the two entities. The goals are to address threats to the stability of both the business groups and deposit-taking commercial banks, as well as to prevent conflict of interest or unfair treatment of consumers.

Collaborate with Relevant Supervisory Authorities

Collaborate with relevant supervisory authorities to (i) to develop framework for supervising and monitoring new dimensions of risks associated with financial business groups, which have implications on the financial system stability; and (ii) to outline appropriate consumer protection framework.

Extend the regulatory purview to include non-bank FIs (NBFIs) and their business groups that provide a wide range of financial services and are systemically important. This is intended to mitigate transmission of risks and prevent abuse of market power that could lead to significant adverse impact on the financial system and consumers at large.

Assess Risks to Regulate NBFIs

Assess risk and systemic importance of NBFIs and their business groups offering diverse financial services. The evaluation will consider:

1. their sizes;

2. interconnectedness and potential risk spillovers to other sectors in the financial system, for example, through large scale bond issuance that can pose risks to the public;

3. the significance of the service providers, both in terms of the degree of substitutability and their potential abuse of market power. For instance, a major creditor in a certain segment or a platform provider with many active users may be regarded as important players; and

4. complexity of potential threats such as those associated with business groups with complicated structure or high volume of complex transactions.

Supervise NBFIs and Their Business Group Offering Diverse Financial Services

More vigilant supervision of systemically important NBFIs, with particular focus on the prudence dimension. These include corporate governance, risk management, maintenance of capital buffer, and preventative measures and contingency plans for stress period designed to mitigate adverse impacts on the financial system and consumers. Consolidated supervision of systematically important NBFIs’ business groups with diverse financial services would also be considered to (i) ensure prudence and limit risk transmissions within group that could potentially undermine stability of the overall business group or significantly important NBFIs within group as well as to (ii) prevent the abuse of market power, conflict of interest, and unfair treatment of consumers. The consolidated approach is consistent with those adopted or under considerations of supervisory agencies in China, the US, and Europe.

Apply activity-based supervision of major retail lenders in terms of consumer protection and macroprudential policy associated with household debt. A supervision guideline for the currently unregulated non-bank retail lenders with high volume of transactions and rapid growth will be issued such as hire-purchase and leasing companies, so they will be under the same supervisory framework as that of commercial banks and regulated non-bank retail lenders.

Apply Risk-Based Approach for IT Supervision

Regulate NBFIs under the supervision of the BOT with a standardized framework for IT/cyber risk supervision and appropriate risk management that suits their risk profiles. The supervision aims to elevate NBFIs’ preparation for increasing IT/cyber risks and limit spillovers to other sectors. At the same time, excessive regulatory burden and costs for the NBFIs would be avoided by (i) allowing them to demonstrate or prove their ability to manage IT/cyber risks through self-assessment exercises and (ii) collaboration with other regulatory authorities to lessen compliance cost and burdens of complying to multiple IT/cyber regulations, for instance, accepting single report submission instead of requesting multiple submissions to each regulatory agency.

Build IT/Cyber Talents

Facilitate IT/cyber capacity building by building human capital on IT/cyber will be leveraged on close collaboration among key financial agencies, e.g. Thailand Banking Sector CERT (TB-CERT), to raise IT/cyber risk awareness among boards and high-level executives of financial institutions. Moreover, the BOT will cooperate with other national agencies such as National Cyber Security Agency (NCSA) to further strengthen IT/cyber expertise and develop a talent pool for the financial sector.

Contact for more information