Macro-prudential Policy

Definition of Macro-Prudential Policy (MaPP)

MaPP are preventive policies aimed at minimizing systemic risk by resolving any small vulnerable part of the financial system and limiting its impact contagion, which eventually lead to financial system failure which would severely impact the economy.

Normally, MaPP are countercyclical in nature meaning that tightening policy is imposed in the upcycle to reduce risk accumulation in financial system and easing policy in the downcycle to fully support the recovery. An example of MaPP is countercyclical buffer policy which requires financial institutions to accumulate additional capital in the period of excessive credit growth while financial institutions are no longer need to hold such capital in the period of credit slowdown. Another example is Loan-to-value (LTV) policy. Low LTV ratio is imposed during economic boom to prevent speculative activities in real estate market while high LTV ratio is imposed during economic downturn to stimulate housing demand.

MaPP can be distinguished from Micro-prudential policy (MiPP) and Monetary policy (MP) by policy objective as follow:

However, one policy tool could act as both MiPP and MaPP, depending on policy objective. For example, the implementation of LTV to encourage bank to strengthen their underwriting standard would be classified as MiPP. On the other hand, if LTV implementation aims to prevent speculative activities in real estate market which is considered a systemic risk, it would be classified as MaPP.

Principles of MaPP

In addition, the BOT cooperates with other regulatory authorities such as the Securities and Exchange Commission (SEC), the Office of Insurance Commission (OIC) and the Cooperative Promotion Department (CPD) to ensure a comprehensive coordination in overseeing the risks of the Thai financial system.

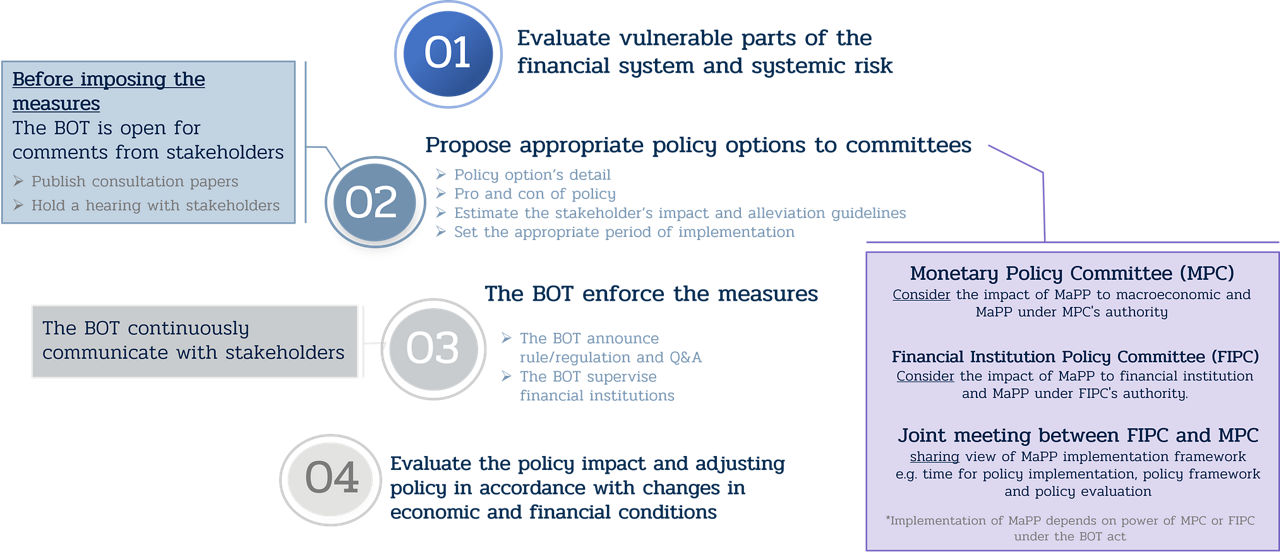

MaPP implementation procedure

MaPP tools are divided into 5 categories.

1. Capital buffer tools

to mitigate losses during recession

ie., Dynamic Provision and Counter-cyclical Buffer (CCyB).

2. Liquidity adequacy tools

ie., Liquidity Coverage Ratio (LCR) requirement and Maturity Mismatch limit.

3. Loan and credit tools

ie., Debt Service Ratio limit (DSR) and Loan-to-value limit (LTV).

4. Interconnectedness risk managing tools

to control contagion risk among sectors in the financial system

ie., Capital Surchage for Domestic Systemically Important Bank (DSIB).

5. Others tools

ie., Cross-border Capital Flow Management.

MaPP that BOT has implemented to ensure financial stability