The second MPC meeting is the decision voting day and the MPC announcement date. The MPC members analyze further economic and financial issues. After that, the MPC members discuss and deliberate the most appropriate monetary policy by taking other policy tools into account. Finally, each MPC member votes on the policy interest rate and provides explanations for the decision.

About Monetary Policy

What is Monetary Policy?

Monetary policy is a central bank's tool for determining the cost of borrowing and money supply in an economy. The Bank of Thailand uses the policy interest rate as a key instrument of the monetary policy.

What is the purpose of the BOT's monetary policy?

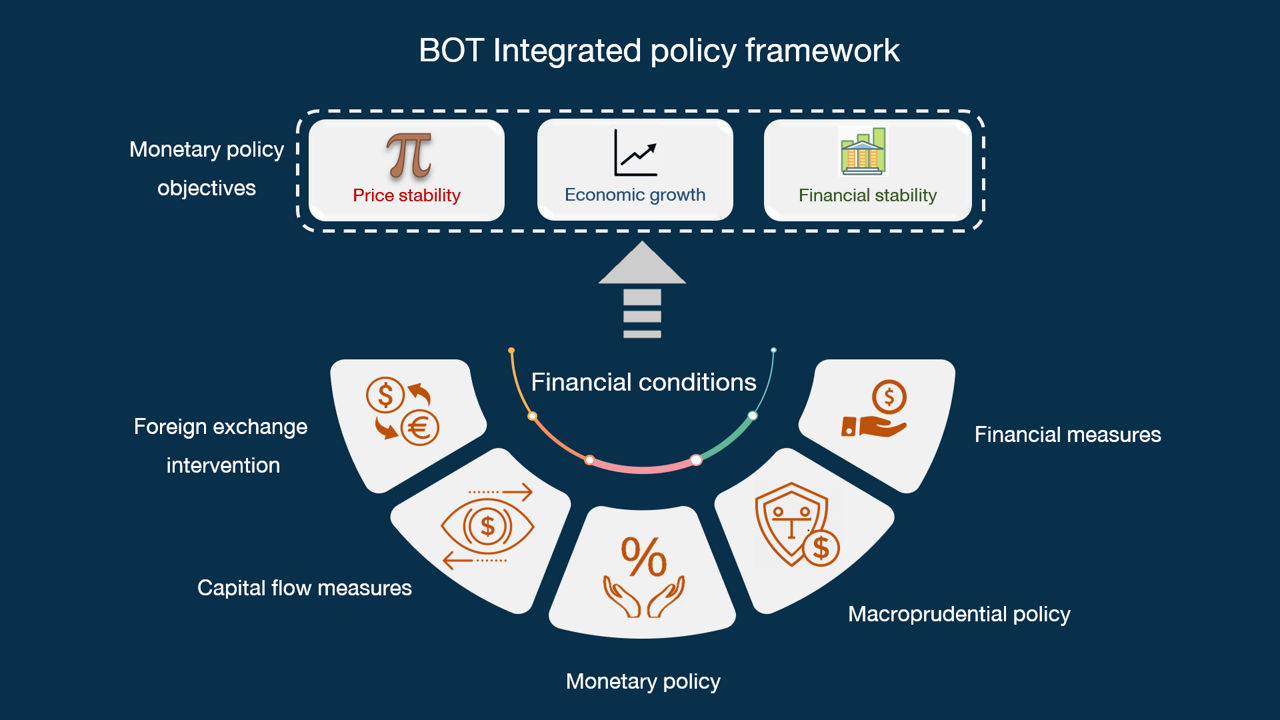

The Bank of Thailand pursues three goals with its monetary policy: medium-term price stability, sustainable economic growth, and financial stability.

Monetary policy has an impact on both the economy and the price of goods and services. A change in the price of products and services is called an inflation rate. An inflation rate that is neither too high nor too low would promote the economic well-being in the long-term. Thus, the Bank of Thailand uses a flexible inflation targeting framework to keep the inflation rate at an appropriate level while promoting full-potential economic growth and a stable financial system.

Because all policies are interconnected, the Bank of Thailand uses a variety of policy tools to achieve its three objectives under the flexible inflation targeting framework, including monetary policy, financial policy, macroprudential policy, exchange rate policy, and capital flow policy. This is called an “integrated policy framework.” Thailand now uses a managed float exchange rate regime. Under this regime, the market mechanism determines the value of the Thai baht and the Bank of Thailand could intervene in case the currency becomes excessively volatile.

What is the procedure for the BOT to determine its monetary policy objective?

The Bank of Thailand and the minister of finance make an agreement on the monetary policy objective for the following year and present it to the cabinet for approval in December of each year. The agreement includes the inflation target for the coming year and the medium term. If the inflation exceeds the target, the governor of the Bank of Thailand will write an open letter to the finance minister explaining the reasons and a policy direction for returning the inflation to the target, as well as a timeframe for doing so. The content of this open letter will be made public.

How does the BOT decide on monetary policy?

The Monetary Policy Committee, or MPC, is the policy-making body that decides on monetary policy by a majority vote. The MPC announces the balance of votes together with the monetary policy decision to the public.

The MPC is made up of seven members. Three of them are executives from the Bank of Thailand, while the other four are experienced professionals from outside the Bank of Thailand. The external members must have economic or financial and banking experiences and have passed the selection procedure. The external members hold the position for 3 years per term and they cannot hold the position more than two terms consecutively.

The Bank of Thailand normally announces the MPC meeting schedule in advance for next year. However, in special circumstances, the MPC can call a special meeting if necessary.

How does the BOT monitor and assess the economy?

The full impact of monetary policy on the economy takes approximately two years. As a result, the Bank of Thailand must conduct a comprehensive analysis of the economy and inflation outlooks. This requires the collection of both quantitative data (e.g. monthly economic data and rapid economic indicators) and qualitative data (e.g. in-depth interviews with nationwide entrepreneurs). This process ensures that monetary policy decisions are in line with the current and future state of the economy.

Apart from the economy and inflation, the Bank of Thailand also closely monitors the financial condition and financial stability statistics in various areas, including corporates, households, and financial institutions, so that the MPC can make well-informed and effective monetary policy decisions.

The procedure of the MPC meeting

The Bank of Thailand staff develops themes and agendas for the monetary policy committee meeting by assessing the economic condition and outlook from all perspectives. The staff will prepare and analyze the crucial data and provide to the MPC members before the first MPC meeting.

The first MPC meeting holds within 1 week before the second MPC meeting. The MPC members discuss the current condition and outlook for a variety of topics, including the economy, inflation, financial market, financial stability, risk factors, scenario analysis, as well as the policy implication.

The monetary policy decision publishes at 14.00 (GMT+7) on the Bank of Thailand website. The Secretary of the MPC holds the press conference and answers the questions regarding the MPC meeting at 14.30 (GMT+7).

The edited minutes of the MPC meeting will be published two weeks later. The monetary policy reports are published quarterly, following by the Monetary Policy Forum event.

How did the independent evaluators assess Thai monetary policy?

The Bank of Thailand (BOT) has adopted flexible inflation targeting as its monetary policy framework since May 2000. In light of 10th anniversary as of 2010, the BOT commissioned an independent evaluation to assess whether such a monetary policy framework is still well suited for Thailand and what changes, if any, need to be made in order to meet the challenges in the period ahead.

-

Press release on summary of the assessment (14 October 2010)

-

Letter from the independent evaluators

-

Executive Summary

-

Report: An independent evaluation of the BOT’s Monetary Policy under the inflation targeting framework, 2000-2010

-

Presentation Slide