Financial stability

The importance of financial stability

Financial Stability can be defined as a healthy financial system which can perform financial services smoothly, including delivering financial services, investment, and funding of various sectors in the economy. Most importantly, a stable financial system must be resilient and can withstand unexpected shocks.

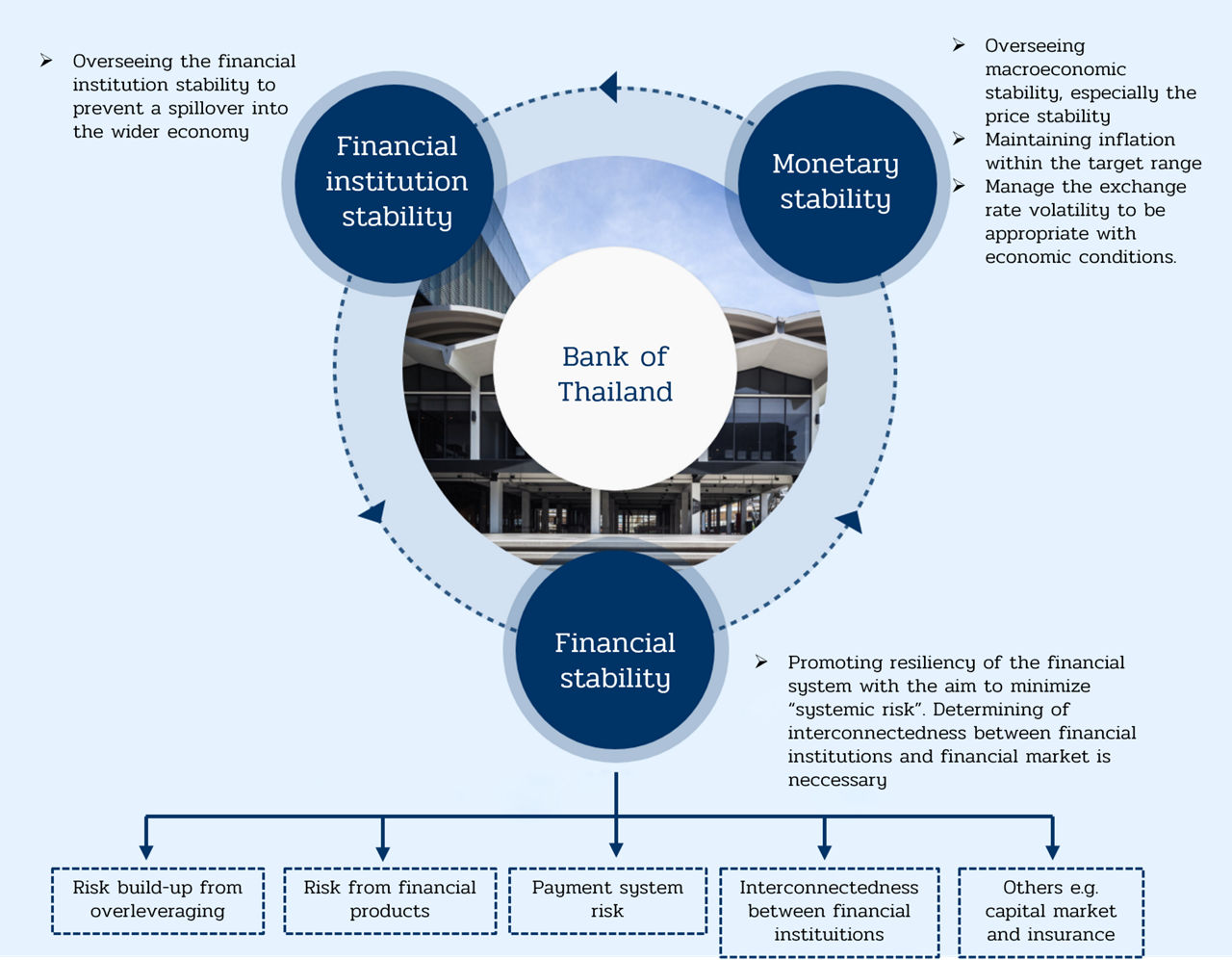

Differences between financial stability, monetary stability, and financial institution stability

Financial stability, price stability and financial institution stability are parts of the BOT’s mandate. The three stabilities have high degrees of interconnectedness.

Why is financial stability necessary?

Financial stability or healthy financial system would enable financial service providers to provide service continuously and smoothly, which is the fundamental for economic well-being in Thailand

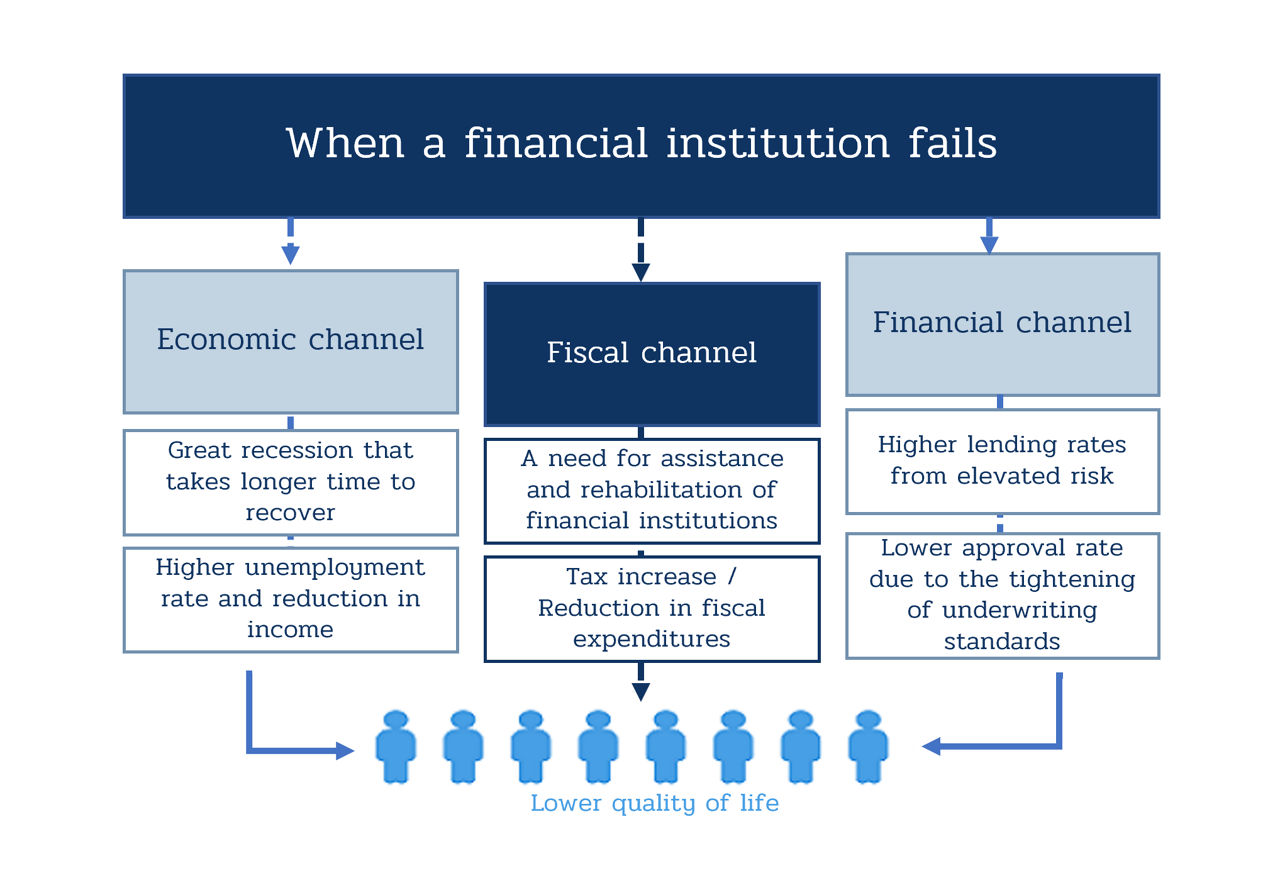

1. A healthy financial system would reduce the severity of financial crisis.

A small spot of vulnerability in the financial system could lead to systemic risk. For example, a growing real estate bubble would lead to a rapid rise in real estate price. Once the bubble burst, the impact would not only affect real estate sector but also spread to financial sector and other related sectors. As a result, this could lead to financial crisis, which will ultimately affect both household and corporate prosperousness.

2. A healthy financial system is important for sustainable economic growth.

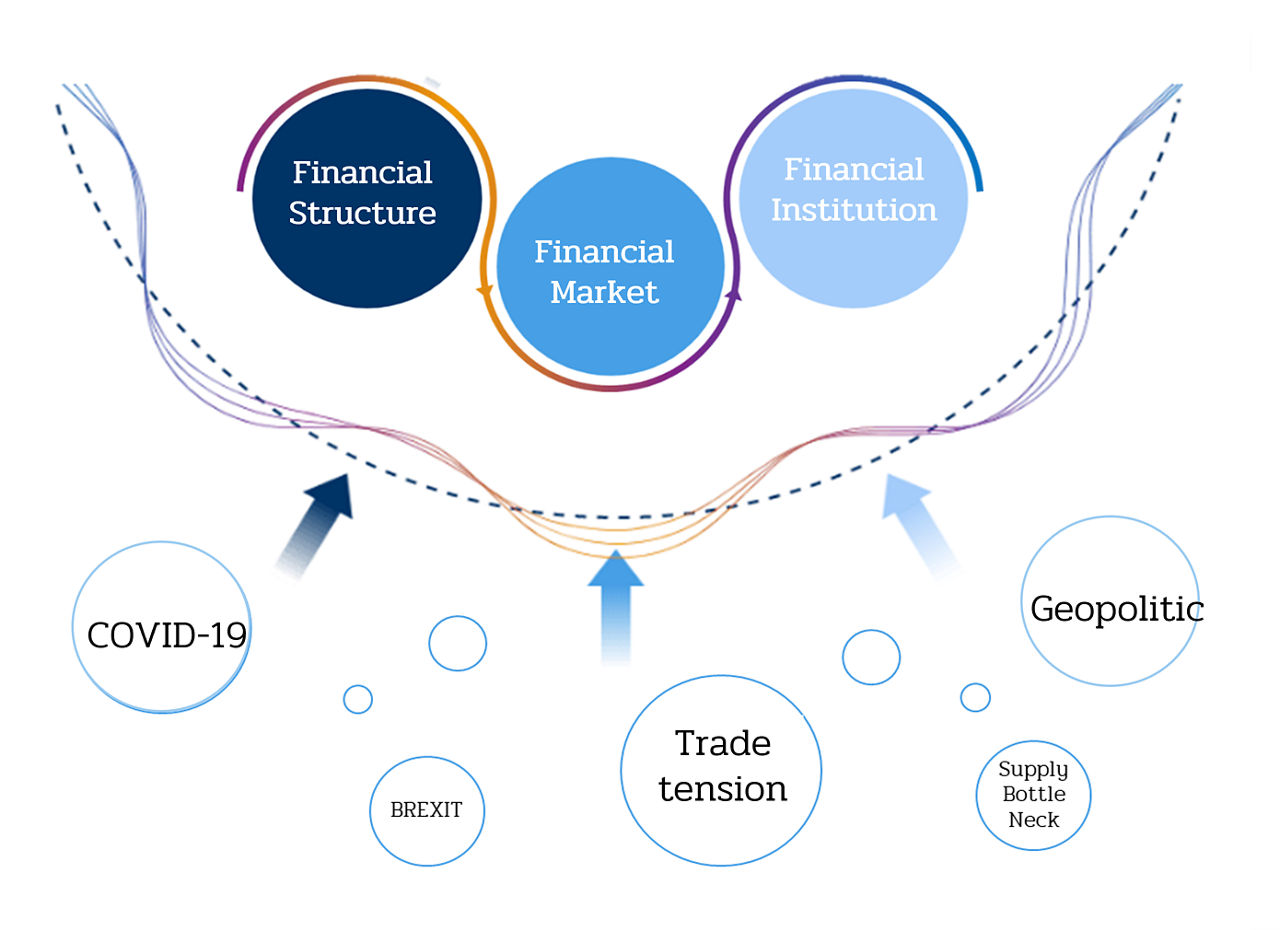

Under a volatile, uncertain, complex and ambiguous (VUCA) environment -ie., COVID-19 pandemic that affects people worldwide, oil price volatility and investment in new digital asset products, global financial system becomes increasingly connected and complex. The more the world becomes unpredicable, the more the need for safeguarding financial system to support sustainable economic growth.