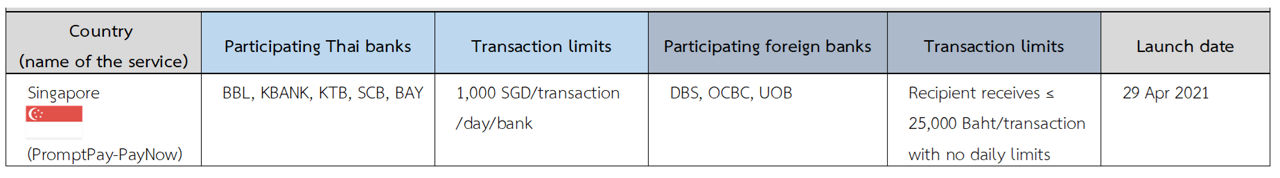

Examples: 1. Singaporean workers in Thailand may transfer money to recipients in Singapore having a DBS, OCBC, or UOB bank account through BBL, KBANK, KTB, or SCB mobile application by using the mobile phone number of the recipient.

2. Thai workers in Singapore may transfer money to recipients in Thailand having a BBL, KBANK, KTB, or SCB bank account through DBS, OCBC, or UOB mobile application by using the mobile phone number of the recipient.

?ts=1701677038164&dpr=off)

?ts=1714040343240&dpr=off)