Project “Your Data”: From Your Data to Better Financial Services

BOT Press Release 38/2024 | 03 Oct 2024

The Bank of Thailand (BOT) held the launch event for the Project "Your Data" for personalized financial services, which is a collaboration between the BOT, the Securities and Exchange Commission (SEC), the Office of Insurance Commission (OIC), and other relevant agencies. The project aims to develop mechanisms that empower users to exercise their right to share their data stored with service providers and organizations to the financial service providers of their choice, conveniently and securely through digital channels. This will allow them to access financial services that better meet their needs, particularly in terms of accessing loans and personalized financial planning. The opening ceremony was led by Mr. Pichai Chunhavajira, Deputy Prime Minister and Minister of Finance, with executives from various government agencies and financial service associations expressing their commitment to jointly driving this project forward.

Mr. Pichai Chunhavajira, Deputy Prime Minister and Minister of Finance, remarked that data is a crucial factor driving Thailand toward a digital economy. The government is actively advancing a range of initiatives that are highly data-driven, including the integration of information from government agencies to enable the development of more targeted and effective policies. In the financial sector, the efficient flow of information is critical to enhancing service delivery and addressing persistent gaps in financial access within Thailand’s financial system. Collaboration between the BOT and other relevant agencies to develop mechanisms that enable citizens and SMEs to digitally share their own data for improved financial services will deliver significant benefits to the public and accelerate the advancement of the country’s digital economy.

Mr. Sethaput Suthiwartnarueput, Governor of the BOT, stated that individuals have the right to utilize their personal data in accordance with the Personal Data Protection Act. The BOT together with all participating agencies in the project “Your Data”, is committed to developing mechanisms that empower people to exercise their right to digitally share their data, both within and beyond the financial sector, so they can access financial services tailored to their needs. These data sharing mechanisms must be convenient, secure, not restrictive of user choice, and practical. For these mechanisms to succeed, it is essential to establish clear rules and regulations to oversee service providers to implement safe, well-governed channels for data sharing with robust user protections, while collaborating with relevant stakeholders in developing standards for data sharing.

Mr. Chuchat Pramunphon, Secretary-General of the OIC, highlighted that the development of mechanisms to support these rights require collaboration across all sectors. Formerly, the OIC has continuously promoted open access to information within the insurance industry (Open Insurance). The development of mechanisms that support customer rights will be another important step for the financial sector, enabling optimal data utilization. This effort will help modernize the insurance business, foster innovation, and empower consumers to choose services that best suit their needs while improving their ability to plan their finances effectively.

Mrs. Waratchya Srimachand, Deputy Secretary-General of the SEC, underscored the significance of this project in advancing the capital market to meet investors’ needs in supporting their financial well-being. The project establishes a mechanism that enables financial service users to benefit from their own data, making it simpler to access financial services or consolidate information on financial and investment status for more effective personal financial management. The SEC will work together with the industry to determine data formats, standards, and data exchange mechanisms, and to promote the development of data aggregators that collect, categorize, analyze, provide investment planning and advisory services. These efforts will lead to investment solutions tailored to investors’ specific needs and goals, thereby enhancing their ability to manage investments and personal finances efficiently and ultimately fostering their wealth in a suitable and targeted manner.

In the last session, financial service providers including Abacus Digital Co., Ltd., Kasikornbank Public Company Limited, Association of Thai Securities Companies, Association of Investment Management Companies, Viriyah Insurance Co., Ltd., and Krungthai Bank Public Company Limited presented concepts and examples of financial services designed to better meet customer needs through mechanisms that enable users to exercise their right to share their own data digitally. These services include digital loan application, allowing submission of diverse data and approval within minutes, targeting individuals who have previously been denied loans by banks or reliant on informal lending channels; centralized financial management that consolidate assets and liabilities in one place to better manage their saving, investment, expenses, and debt; personalized insurance offerings tailored to individual customer profiles such as coverage linked to deposit values or assets; advanced solutions for corporate clients to support lending and financial management needs.

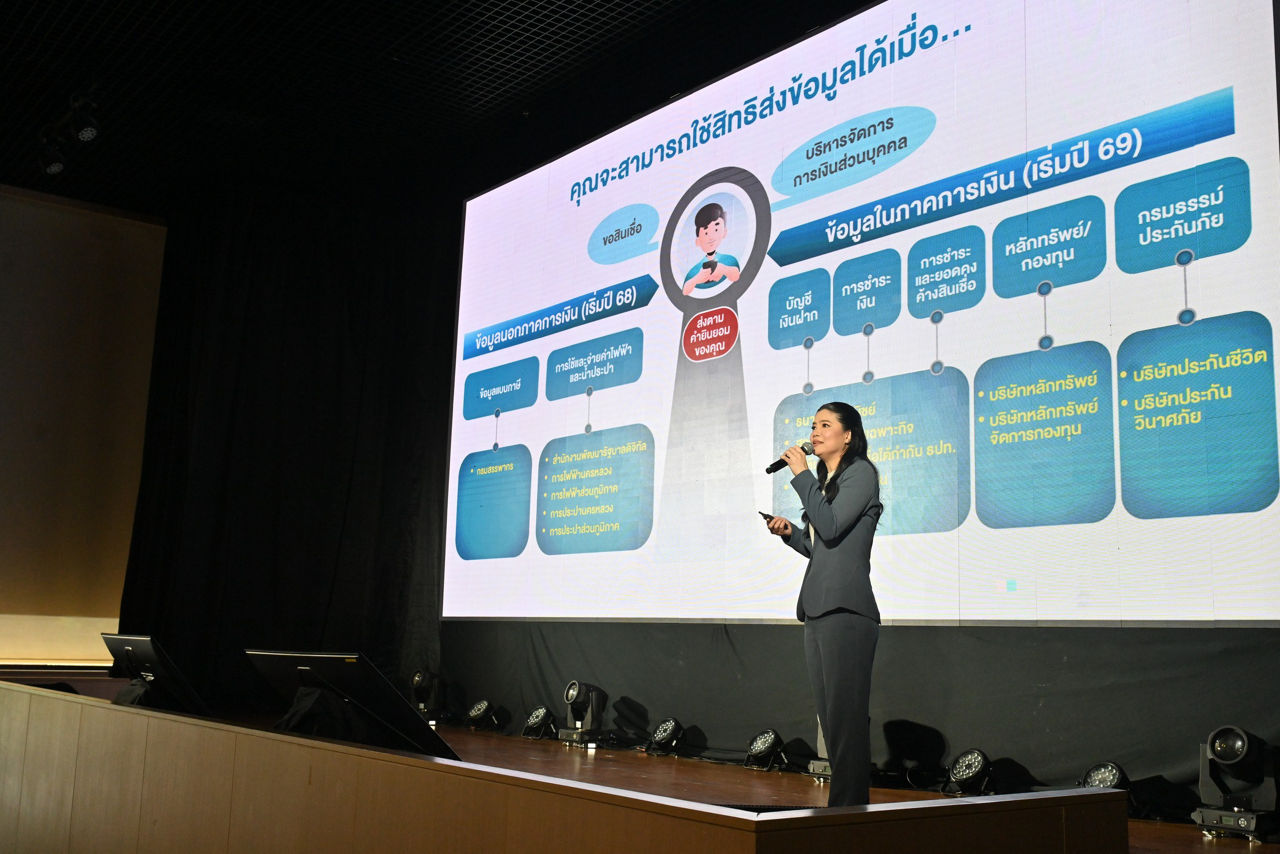

The BOT believes that enabling users to exercise their right to share their own data under the Your Data project will mark a significant step toward improving access to financial services and closing financial gaps. The BOT plans to issue rules and regulations for data sharing mechanisms within the banking sector in the first half of 2025 and begin implementing standards throughout 2025. Consequently, users are expected to start exercising their data sharing in the second half of 2026. This timeline aligns with the implementation schedules in the capital market and insurance sector. For the use of data sharing beyond the financial sector, it is expected that users will be able to utilize tax filing as well as electricity and water usage and payment data in 2025.

Bank of Thailand

3 October 2024

Supporting Documents (TH)

- Opening Remarks: Mr. Pichai Chunhavajira, Deputy Prime Minister and Minister of Finance on "Enhancing the digital finance economy with data"

- Speech by Mr. Sethaput Suthiwartnarueput, Governor of the Bank of Thailand "Create financial opportunities with your data"

- Speech by Mr. Chuchat Pramunphon, Secretary General of the Office of Insurance Commission on "Strengthening the right to use information, empowering an insurance service that understands you"

- Speech by Mrs. Waratchya Srimachand, Deputy Secretary-General of the Security and Exchange Commission on " Strengthen your financial management ability with your own data”

- Lecture on the development of the user's data transferring mechanism ‘from Idea to I do’