Thai Bankers Association

The BOT and the Thai Bankers Association (TBA) jointly signed a memorandum of understanding on Sustainable Banking Guidelines: Responsible Lending on August 13, 2019, during the Bangkok Sustainable Banking Forum 2019.

TBASustainable Banking Guidelines –

Responsible Lending

The BOT and the Thai Bankers Association (TBA) jointly signed a memorandum of understanding on Sustainable Banking Guidelines: Responsible Lending on August 13, 2019, during the Bangkok Sustainable Banking Forum 2019.

TBA

The BOT and the Association of International Banks (AIB) jointly signed a memorandum of understanding on Sustainable Banking Guidelines: Responsible Lending on February 13, 2020.

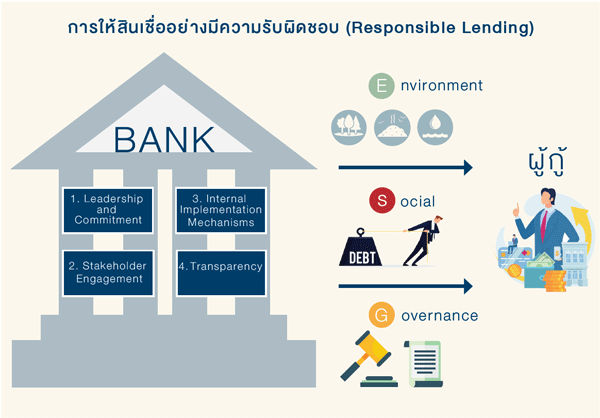

AIBThe memorandum of understanding on Sustainable Banking Guidelines: Responsible Lending aims to serve as a framework for commercial banks, which play a critical role as capital allocators in driving economic system, to conduct business under the principles of “Sustainable Banking.” This means integrating Environmental, Social, and Governance (ESG) aspects into the development of responsible lending policies and strategies, as well as having processes to manage risks and impacts arising from banks’ lending activities.

Responsible Lending Guidelines consist of 4 key components that commercial banks should prioritize to ensure the effective implementation of their responsible lending strategies. These components are as follows: